In Part One we looked at the process of planning for your future. We also saw how inflation can hurt us, and why knowing accounting can save us a world of pain in the long and short term.

In this final part we’ll look at how you can structure your money to arrive at an ‘acceptable’ hourly rate to charge your clients when starting out.

| Disclaimer: This article is written for understanding and information purposes only. It does not constitute or replace professional legal or financial advice. Do not take any action based on the words in this article. You are responsible for your own actions and finances. |

The exponential curve

A Jedi must have the deepest commitment, the most serious mind. This one a long time have I watched. All his life has he looked away… to the future, to the horizon. Never his mind on where he was. Hmm? What he was doing. Hmph. Adventure. Heh. Excitement. Heh. A Jedi craves not these things – Yoda, The Empire Strikes Back

The path of the freelancer or entrepreneur is hard, not because of the work involved – but because he or she must swim the same waters as those who are not.

Comparisons are inevitable. Many a freelancer gives up hope because they cannot stand the constant comparisons: “Your friend is earning xxx, why can’t you?” “Why don’t you get a decent job?” “Why can’t you take a couple of days off?” The constant push and pull of being bred on “go to school-get a job” but wanting to “be on your own” is hard, especially when it involves money.

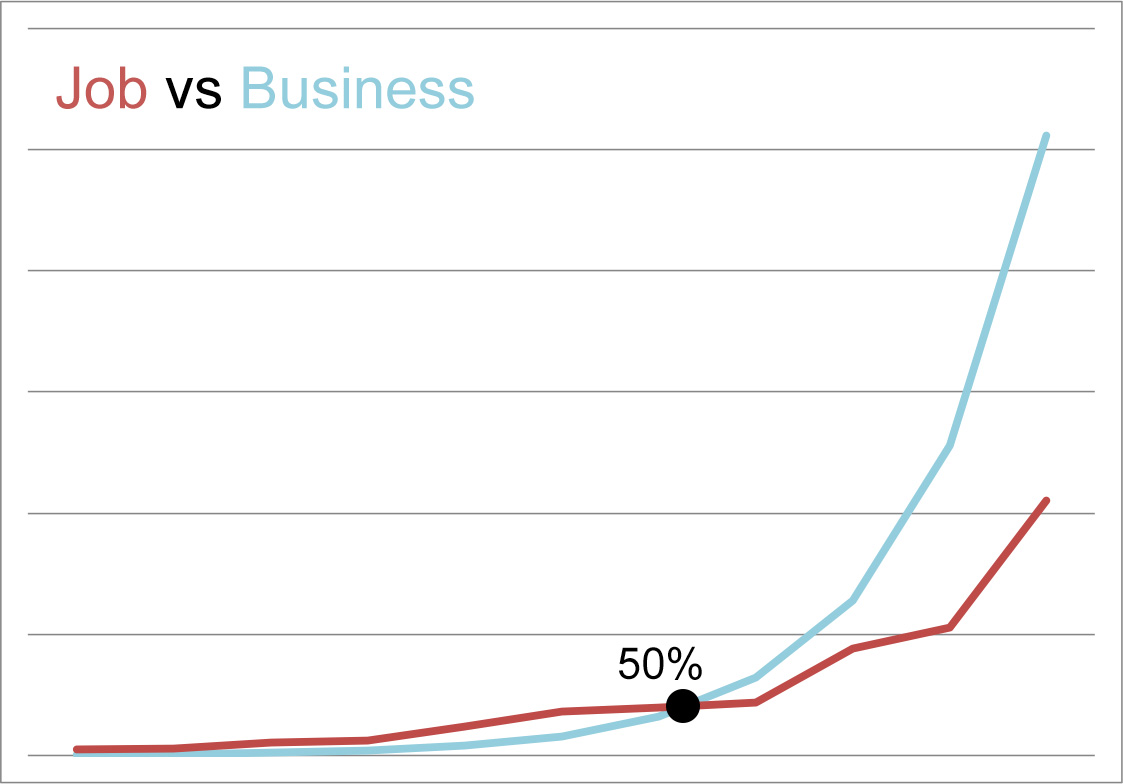

The typical earnings path of the employee vs the freelancer or entrepreneur is as follows:

The blue line is what is called an exponential curve. The curve starts small, even at one. But every subsequent year, you grow your business as a multiple of the first number. If you have zero clients today, you’ll have one by the end of this year. Sounds low? This is how the sequence goes: 2015 – 2, 2016 – 4 clients, 2017 – 8, 2018 – 16, 2019 – 32 and 2020 – 64. If each project takes up a week of your time, you’ll only be employed for one week the whole of this year. By 2020, you won’t have enough weeks.

On the other hand, an employee follows the red curve. Salary increases by about 10-20% annually (in a good economy or if business is booming). Once in a while, you get promoted or find another job and your salary doubles. It gets better as you rise along the corporate ladder (if that’s your job). When you retire, you get a large payoff and some benefits.

Study the beginning of the curve. Initially, the employee will always have a higher salary and career path. This is when freelancers and entrepreneurs are in the ‘low zone’, feel dejected and give up. Those who survive will live to see the 50% or half-way stage. In a 30 year career started at the age of 22, the 50% stage comes at age 37. That’s when your faith in business and your skills begins to pay off in a tangible way. It’s only then that others see it as well.

After that point you are unstoppable. You have the one skill that will help you no matter what the state of the economy – you can sell. An employee is only trained to work, not hunt. Even if you lose all your clients tomorrow, you can bounce back because you know how to start from scratch.

Understanding that the path of the entrepreneur is an exponential one will help you keep your head level while the world moves along. You’ll catch up and go past them. The only thing you have to do is never stop believing.

Billable hours in your life

There are only 24 hours per day, out of which you might want to sleep for at least 6. Take away a couple of hours for eating, traveling, whatever, and you’re down to 16 hours.

In a year, you might want to account for at least 15 days for a holiday (or you’ll burn out), and maybe another 15 days for illness (if it doesn’t come consider it a bonus). That means you only have 335 days a year of fanatic working. If you want to take Sundays off, you have less than 300 days.

At 16 hours of work per day, you will have about 4,800 hours a year (92 hours a week). That’s being a workaholic, and unrealistic. Sooner or later it’ll take a toll on you. In the real world, you might hit your limit at 70 hours per week (equates to 12 hours a day, more likely). This equates to 3,640 hours a year.

Now, let’s assume you estimate working for 30 years. You’ll have a total of 109,200 hours of productive time. Can you hope to get paid for each and every hour of that time? Nope, not if you’re a freelancer. You might only get paid for one-third of that time.

This means:

- You have 36,500 hours to bill, total.

- 1,200 hours to bill, per year.

- 100 hours to bill, per month.

- 25 hours to bill, per week.

- 4 hours to bill, per day.

Bottom line, if you’re working 12-hour days, you’ll need to charge three times what it costs you per hour. Even when you grow your business and have employees and multiple projects, you’ll still need to charge more than what you need per hour. In the beginning though, stick to the 3x formula – assuming you’re a hard worker. If you’re only working 8 hours, then you might want to charge 4x.

Dealing with your professional life

To meet your goals, you must follow this rule of thumb:

I’ll explain what this means shortly. The point is, you have to earn for today and tomorrow, and the day after, too.

But you don’t have to earn it all right now, because your path is an exponential one. You just have to earn in the right proportion. In the end when you need it, you’ll have it all.

Before I look at each of the above parts individually, let’s look at one thing that takes away from your earnings.

Taxes

Common to all expenses is taxes. If you’re in business, you’ll pay taxes. If you’re drawing a salary from your business, or if you’re earning a freelancing salary, you’ll pay taxes. If you’re investing money and earning from interest, you’ll pay taxes.

Finally, if you own a home and have wealth, you’ll pay taxes. Even when you die and pass on your inheritance, your ‘estate’ will pay taxes.

I’m not going into details on taxes, and maybe neither should you. You’re at the bottom of the exponential curve at the beginning. You have nothing to lose. Why waste time worrying about taxes when you must use all your energies to get and satisfy clients? Any check you write to the government is official, so it’s not like you’ll get conned.

Talk to an accountant, and rely on his or her expertise to fix your taxes for you. Get the bottom line, and that should be good enough at the beginning. As you move along and gain more experience, you’ll learn a lot more.

Contingency or Wealth

It is difficult to put a cap on wealth. Most people wouldn’t mind a billion or two, but few will ever see it.

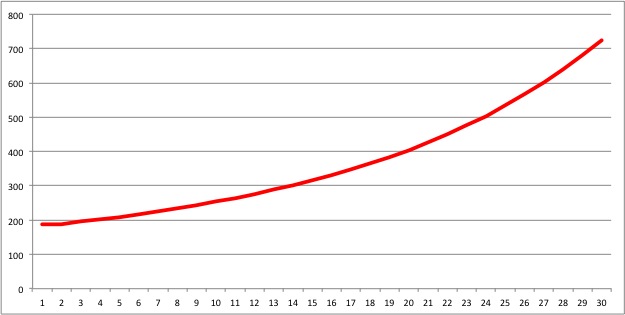

Say you want 1,000,000 in the bank to take to your grave. As we saw earlier, you have to account for inflation, and assuming it is at the rate of 1.5% steadily, you’ll really need 2 million. If you choose an SIP (not recommending it, just an example) at 6% annually (0.5% per month), and make monthly payments without fail for 30 years, this is what it’ll look like:

| Wealth | 2,000,000 |

| Annual Rate SIP | 6% |

| Months | 360 |

| Monthly Payment | 1,991 |

In this example, you’ll need to invest about 2,000 a month without fail for 30 years. That’s 2,000 x 12 (months) x 30 (years) = 720,000. Now, all this is assuming you don’t have to pay taxes on your income – this is where your accountant will come to your rescue.

How much should you charge just to reach your contingency? 720,000/109,200 = 6.6 per hour. But we know you need to charge thrice that amount, so you’ll charge 20 extra per hour just make a million (in today’s money) at the end.

20 an hour for 100 hours a month is 2,000 per month. Think you can swing that?

I’m not saying you should opt for a million (actually 2 million) at the end. Choose whatever you feel is right for you.

Retirement Expenses

How much do you plan on spending after you’ve retired? Hopefully you won’t have to pay off any loans at that point, and will be totally debt-free. You’ll have medical and lifestyle expenses, but that’s about it for most folks.

The simplest way to find out how much you should estimate is ask someone whose lifestyle you would like to emulate. If you don’t have any rich uncles, use the Internet. It shouldn’t be hard to find out the monthly expenditure of a person if you know the vicinity of their abode.

Let’s say this income is 100,000 a year (in today’s money). At current estimates, you could live up to an age of 90, but why not aim for a 100? That’s 45 years of life post retirement. You could almost have a second career!

Because of inflation, you’ll really need 200,000 in your first year of retirement, and it will go up to 400,000 by the 30th year of retirement (you’re 85), and so on. If you don’t take interest on investments into consideration after you retire, you’ll need about 17 million.

This is why your money should ideally also earn interest while it waits to get spent. This way you don’t have to make that 17 million upfront.

The simplest way to get this done is own a business, property or investment that pays you your retirement expenses every year while appreciating at a rate that covers not only your retirement expenses but also inflation and any taxes you might have to pay.

E.g., if you need to spend 200,000 when you’re 55, and about 600,000 when you’re 100, you’ll need to find an investment, property or business that can give you:

- 200,000 per year. If that’s 10% of your total investment, then your asset should be worth 2 million.

- 2.5% per year for inflation, and

- 30% of your earnings (10% of your asset) for taxes, accounting for both your asset should be worth 3 million.

This means, you might have a property (apartment complex, motel, etc.), business (your own business, other small businesses, etc.) or investment (stocks, bonds, businesses, loans, etc.) that is worth 3 million when you’re 55 and gives you about 15.5% annually so you can lead your dream retirement.

Just to keep things simple, I’m going to assume you need 3 million when you’re 55. Therefore, using the same system we used for contingency/wealth, we arrive at an hourly billing of 30/hr, or 3,000 per month.

There are many factors that change this: You might work longer or shorter, the economy might prosper or go kaput, wars may happen or you might win the lottery. But, the goal is start with a basic but good plan, and hope for the best. If you’re having trouble arriving at the right amounts, speak to friends, family and loved ones. Also don’t forget to seek the advice of an experienced accountant.

Private Expenses

These are what you are spending and will be spending over the course of your working career. It includes health, school, transport, food, living, travel, clothes and the million other things that people need to live a certain lifestyle. And, of course, taxes.

Let’s say you imagine 100,000 a year will give you the lifestyle you want (including taxes). We’re just following the same example as above. You’ll need to earn about $83 per hour, or $8,333 a month, billing for 100 hours per month.

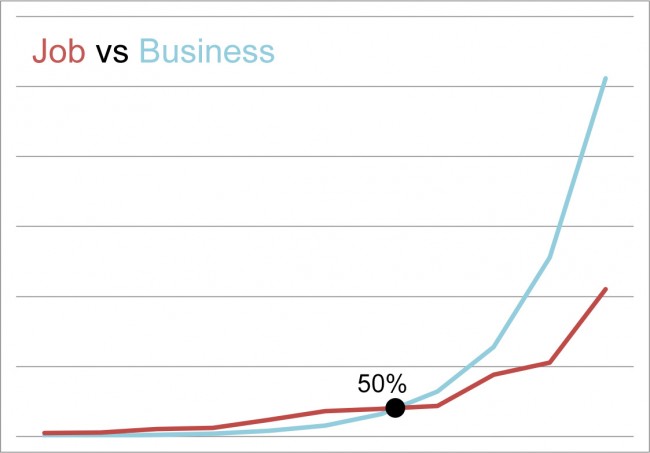

Because of inflation, you’ll need to spend more every passing year, and this is what it’ll look like:

By age 55, you’ll be charging about 167/hr. That doesn’t seem very high, but you must be able to bill for 100 hours consistently.

Business Expenses

These are expenses directly relating to your line of work. Cameras, computers, software, whatever, including taxes, salaries, rentals, office expenses, prospecting, marketing, advertising, non-payments, etc. In many countries, these are business expenses and don’t have to be taxed. Check with your accountant and lawyer on what the right business structure is for your operation.

In any case, you must account for your expenses when billing clients. Of course, if there are project related expenses, like hiring crew or materials, travel, etc., that will be added.

Let me show you how I do it. I’m not saying it’s perfect, but it’s the only way I know. First, start with the Month and Year:

| Year | Month |

| 2014 | Jan |

| Feb | |

| Mar | |

| Apr | |

| May | |

| Jun | |

| Jul | |

| Aug | |

| Sep | |

| Oct | |

| Nov | |

| Dec | |

| 2015 | Jan |

| Feb | |

| Mar | |

| Apr | |

| May | |

| Jun | |

| Jul | |

| Aug | |

| Sep | |

| Oct | |

| Nov | |

| Dec | |

| 2016 | Jan |

| Feb | |

| Mar | |

| Apr | |

| May | |

| Jun | |

| Jul | |

| Aug | |

| Sep | |

| Oct | |

| Nov | |

| Dec | |

| 2017 | |

| 2018 | |

| 2019 | |

| 2020 | |

| 2021 | |

| 2022 | |

| 2023 | |

Notes:

- You can do this horizontally or vertically. I’ve shown the latter here because horizontally won’t fit on a web page. In the real world, it is done horizontally and I print it out on A3 paper.

- You only need to plan for about 3 years in detail, though you should have a 10-year business plan. Nobody can see that far, but you must have a plan. The 10-year plan can be very general, just a few words on paper. The 5 year plan will be more detailed, and the 3-year plan should be very detailed, at least on all matters financial.

The next step is to find out what happens during these months. You decide! A business has the following kinds of expenses:

- Operating expenses, or overheads.

- Project-related expenses, like rentals, travel, per diems, etc.

- Salaries* to employees. If it’s just you, we’ve already covered that in the previous section.

*Salaries really mean CTC (Cost To Company). These include salary, space, computers, benefits, etc. If you’re having trouble thinking that far, usually the CTC is between two to three times an employee’s salary. Ouch.

Operating Expenses

Start by listing every single item bought for your business, and total it. If you’ve taken a loan and are paying monthly installments, put that figure against the month on your chart.

Next, list down items that will help you grow your business, and put that against when you plan to buy them. Most equipment nowadays only have a shelf life of 3 years. By that time you will be forced to upgrade. This applies to cameras, computers, etc. There are some exceptions like lenses, hard drives, etc. A ten year plan will have about three ‘upgrade’ cycles. You could buy these outright with cash, or put them on a card, or buy with financing.

Finally, list down all the monthly expenses – rent, electricity, travel, credit card, Internet, phone, hosting, stationary, maintenance, accountants, lawyers, taxes, you name it. Try to figure out how much they will cost over the next 10 years. Don’t forget to add inflation to the lot. Here’s an example of what it’ll look like:

| Month | Current Loans | To Buy | Overheads | Total Monthly | Hourly |

| Jan | 498 | 2345 | 2843 | 28 | |

| Feb | 498 | 3400 | 2345 | 6243 | 62 |

| Mar | 498 | 2345 | 2843 | 28 | |

| Apr | 498 | 2345 | 2843 | 28 | |

| May | 498 | 2345 | 2843 | 28 | |

| Jun | 498 | 245 | 2345 | 3088 | 31 |

| Jul | 498 | 145 | 2345 | 2988 | 30 |

| Aug | 498 | 2345 | 2843 | 28 | |

| Sep | 498 | 2345 | 2843 | 28 | |

| Oct | 498 | 2345 | 2843 | 28 | |

| Nov | 498 | 2345 | 2843 | 28 | |

| Dec | 498 | 987 | 2345 | 3830 | 38 |

| Jan | 498 | 120 | 2580 | 3198 | 32 |

| Feb | 498 | 2837 | 3335 | 33 | |

| Mar | 498 | 3121 | 3619 | 36 | |

| Apr | 498 | 3433 | 3931 | 39 | |

| May | 498 | 3777 | 4275 | 43 | |

| Jun | 498 | 4154 | 4652 | 47 | |

| Jul | 498 | 4570 | 5068 | 51 | |

| Aug | 5027 | 5027 | 50 | ||

| Sep | 5529 | 5529 | 55 |

Notes:

- The current loans will stop at one point. New items will be either full price or monthly payments.

- The last column shows you how much you must charge just to take care of your office expenses or overheads.

Project-related expenses and salaries

If you’re starting out, it’s highly unlikely you’ll have employees. You’re more likely to hire help whenever needed.

Now, depending on what kind of job you’re into, you only have certain hours to complete it. E.g., a corporate video might take a week to do, if you’re doing it yourself. This includes a day or two of shooting and prep. It includes a day or two of post production, and a day or two for revisions or unforeseen events. Now, the wrong thing to do is to assume you can do four videos in a month. You’ll need to account for time prospecting and marketing your business, and also time to handle your accounts, getting paid (which might takes months of calling!), and so on. Realistically, you can expect to do two projects a month if you’re a single person crew.

This means, you will bill each client for 50 hours. Two clients will get you your 100 hours per month. 50 hours is about six 8 hour days – which makes up your week.

If you’re a freelance camera person or editor, you can work for more hours a month, but can’t charge as much (there is such a thing as competition, you know). Finding the right project-related expenses is a combination of math, common sense and current market realities. What are your peers charging? How much are clients willing to pay? You can only find these things out by talking to other people.

Just to round up our example, let’s say one project costs you about 1,000 in project-related expenses – which might include travel, hiring one crew member, per diems, media, dispensables, etc. This is what the final chart will look like:

| Year | Overheads | Project Expenses | Total | Hourly Rate |

| 2014 | 40000 | 24000 | 64000 | 53 |

| 2015 | 42500 | 26400 | 68900 | 57 |

| 2016 | 45000 | 29040 | 74040 | 62 |

| 2017 | 47500 | 31944 | 79444 | 66 |

| 2018 | 50000 | 35138 | 85138 | 71 |

| 2019 | 52500 | 38652 | 91152 | 76 |

| 2020 | 55000 | 42517 | 97517 | 81 |

| 2021 | 57500 | 46769 | 104269 | 87 |

| 2022 | 60000 | 51446 | 111446 | 93 |

| 2023 | 62500 | 56591 | 119091 | 99 |

Business accounting moves in yearly cycles, and that’s what you should try to do as well. The key to managing your rates is by spreading your expenses as evenly and realistically as possible (which means, you need to estimate your own ability to get work).

Also, don’t forget to add things like resale of used gear, buying bigger offices and renting out some space, billing more, working on larger and more lucrative projects, etc. It’s all part of your business plan.

Putting everything together

Under no circumstances should you assume the numbers I’ve put together are realistic or likely. You must arrive at realistic values based on your ability, the market and circumstances.

Just for fun, let’s add up everything we’ve put together for the first year:

- Contingency – 20/hr

- Retirement – 30/hr

- Private Expenses – 83/hr

- Business Expenses – 53/hr

That’s a total of 186 an hour beginning right now, assuming you can bill 100 hours a month. If you can’t find clients that quickly, lower your sights.

Why is this amount so high? Because it includes things like retirement and business expenses, which most freelancers don’t consider.

How can you reduce this figure? You could live more frugally, both now and in the future. You could rent equipment instead of buying them, have a smaller office, etc. You could bring it to 100 an hour, or even 10 an hour, as long as you’re willing to live with the consequences. Of course, you could also work longer hours and earn the same, but then you’re going into the ‘job zone’ and have less time to find new business, get into new ventures, etc.

Remember, free lancing is 50% being on the road, and only 50% poking your lance.

If you’re curious to know, your average project in 2014 is worth 9,300, and if you do two projects a month you need a turnover of 18,600 a month or 223,200 a year. 30 years from now, your average project will be worth about 36,000, and you’ll have an annual turnover of 864,000.

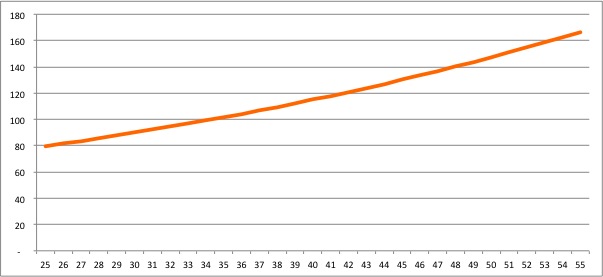

And, guess what your hourly rate looks like? Here’s the chart:

I think you recognize an exponential curve when you see one, right? This one is, too, but it’s slow. The key to making it look like the first graph on this page is to scale your business. What does this mean?

- Add more employees

- Get a bigger office

- Take up multiple projects

- Bid for and win larger projects

- Open multiple businesses

- Invest in other things

That’s how the game is played. And you can start as small as you want. You make the rules. Your hourly rate is yours to pick, and yours to earn. If you’re a soldier your hourly rate is not your medal, it’s your uniform. It is unquestionable.

Start galloping, free lancer.